Gifts That Pay You Income

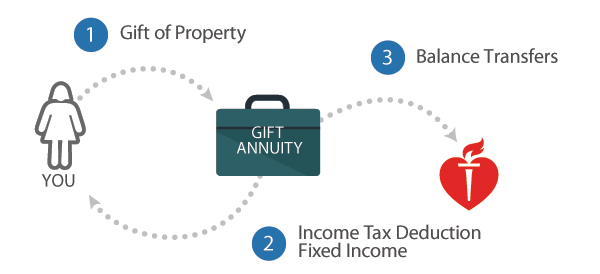

Charitable Gift Annuities

About This Gift

If you’re looking for a way to maintain your current lifestyle, increase your financial security, and lower your taxes, consider creating a charitable gift annuity. You will receive fixed annual payments for as long as you live and your gift will make a difference in our future.

How It Works

- You transfer cash or securities to the association.

- The association pays you, or up to two annuitants fixed income for life.

- The remaining funds pass to the association when the contract ends.

Benefits

- You receive an immediate income tax deduction for a portion of your gift.

- Your annuity payments are guaranteed for life, backed by a reserve and the assets of the association.

- Your annuity payments are partially tax free.

- You can have the satisfaction of making a gift now that benefits you and the association.

Request a Personal Illustration Request Form

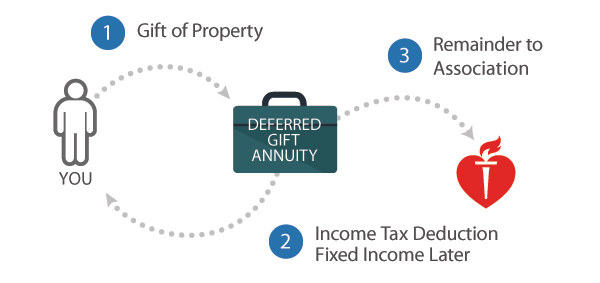

Deferred Gift Annuities

About This Gift

Just like a standard charitable gift annuity you can support our fight against heart diseases and stroke, secure your future finances, receive an immediate tax deduction, and receive fixed income payments for life. But, with a deferred gift annuity you start receiving fixed payments at a set date later in life. Delaying payments until a later date allows for you to benefit from higher rates of return that continue to increase the longer you defer them.

How It Works

- You transfer cash, securities, or other property to the association.

- Beginning on a specified date in the future, the association begins to pay you, or up to two annuitants fixed payments for life.

- The remaining funds pass to the association when the contract ends.

Benefits

- You receive an immediate income tax deduction for a portion of your gift.

- You can postpone your annuity payments until you need them, such as when you reach retirement or when a grandchild begins his or her college education.

- The longer you defer your payments, the higher the payout rate you will receive.

- You can have the satisfaction of making a gift now that benefits you and the association's mission.

Request a Personal Illustration Request Form

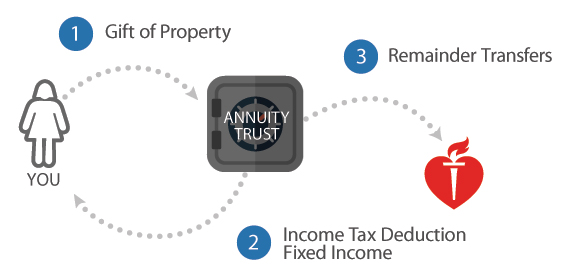

Charitable Remainder Annuity Trust

About This Gift

Your charitable remainder annuity trust is a great way to provide yourself or your beneficiaries with a steady, fixed amount of income each year regardless of the performance of the trust. This can be done for a specified length of time up to 20 years, your lifetime, or your beneficiaries’ lifetime. When the contract ends the remaining funds will be transferred to the association, and used in our efforts to battle heart diseases and stroke.

How It Works

- You transfer cash, securities, or other appreciated property into your trust.

- The trust makes fixed annual payments to you or anyone you name.

- When the trust ends, the remaining funds pass to the association.

Benefits

- You receive an immediate income tax deduction for a portion of your contribution to your trust.

- You don’t pay capital gains tax on any appreciated assets you donate.

- You or your designated income beneficiaries receive stable, predictable income for life or a term of years.

- You have the satisfaction of making a gift that benefits you and the association.

Request a Personal Illustration Request Form

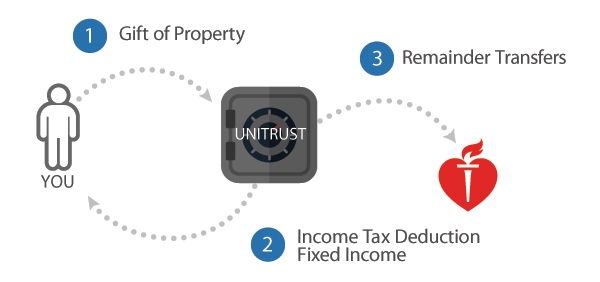

Charitable Remainder Unitrust

About This Gift

The value of the assets you use to fund your charitable remainder unitrust will determine the income payment percentage that you or your beneficiary will receive annually for making the gift. The percentage of payment can be up to 50% of the assets fair market value. Your trust’s assets will be valued on an annual basis to determine the amount you will receive. This gift also allows the flexibility of additional gifts if you wish to add to your gift at any time.

How It Works

- You transfer cash, securities, or other appreciated property into your trust.

- Your trust pays a percentage of the market value of the assets re-valued annually to you or to beneficiaries you name.

- When your trust ends, the remaining funds pass to the association.

Benefits

- You receive an immediate income tax deduction for a portion of your contribution to your trust.

- You do not pay capital gains tax on appreciated assets you donate.

- You or your designated beneficiaries receive income for life or a term of years.

- You can make additional gifts to the trust as your circumstances allow and qualify for additional tax deductions.

- You have the satisfaction of making a gift that benefits you and the association.