Gifts That Protect Your Assets

Charitable Lead Trust

About This Gift

With a charitable lead trust, you can donate to the association, and then pass your assets to your heirs at reduced tax rates. There are several types of lead trusts that you can use to show your support of the association. You can fund your trust with cash, stock, bonds, land, or other assets.

How It Works

- You contribute cash, securities or other property to your trust.

- Your trust makes annual payments to the association for a specified term of years.

- When your trust ends, the remaining funds go to your heirs.

Benefits

- You qualify for a tax deduction.

- The payments reduce or even eliminate the transfer taxes due when the remaining funds revert to your heirs.

- All appreciation that takes place in your trust becomes tax-free to your heirs.

- You can use your available estate tax credit (consult with your financial advisor for the current applicable amount) to further reduce the taxes on transfers to your heirs.

- You have the satisfaction of making a gift to the association now that reduces the taxes due on transfers to your heirs later.

View the Charitable Lead Annuity Trust Gift Calculator(link opens in new window)

View the Charitable Lead Unitrust Gift Calculator(link opens in new window)

Request a Personal Illustration Request Form

Retained Life Estate

About This Gift

Give a gift of your real estate to the association, while continuing to live in and/or use the property during your lifetime. If the property is a long-term asset (held for over one year), you may receive an income tax deduction based on the appraised value. The proceeds on the sale of the estate after tenancy terminates will help fund the fight against cardiovascular diseases and stroke.

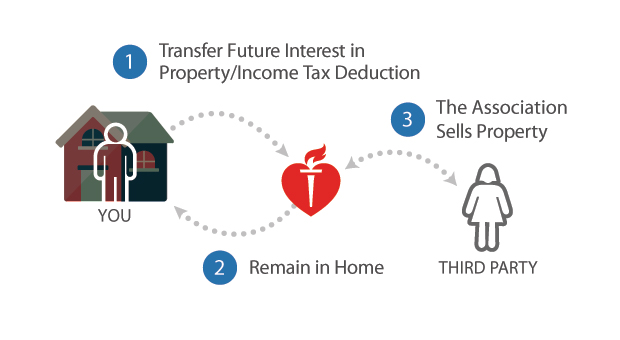

How It Works

- You transfer your residence, farm, or vacation home to the association subject to a life estate.

- You continue to live in the property for life or a specified term of years, while continuing to be responsible for all taxes and upkeep.

- The property passes to the association when your life estate ends.

Benefits

- You receive an immediate income tax deduction for a portion of the appraised value of your property.

- You can terminate your life estate at any time and take an additional income tax deduction.

- You can have the satisfaction of making a gift now that benefits the association later.

View the Retained Life Estate Gift Calculator(link opens in new window)